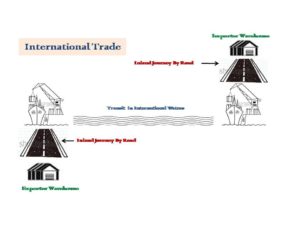

Marine cargo insurance occupies an important position in international trade, for that matter in kind of trade. Whilst it is primarily concerned with the protection of ocean-going cargo it also covers against the hazards associated with connecting land conveyances as well as shipments by mail or air. The cargo insurance need to be obtained prior to consignment starts its onward journey for the first time from the manufacturer/supplier’s place of storage.

Goods being transported anywhere in the world are exposed to a wide range of risks some of which include loss or damage due to:

- theft, pilferage or hijack;

- mistakes in transportation such as dropping, rough or inappropriate handling;

- accident to the carrying conveyance such as a vessel sinking, aircraft crashing or vehicle fire, road traffic accident or overturning;

- exposure to rain or salt water;

- variations in temperature.

- Piracy

- Jettisoning of the Cargo during Transit

Since the Cargo is entrusted to a carrier (Bailee) for transportation almost all the risk listed above are difficult for the shipper to manage directly. The carrier, on the basis of various conventions limit their liability for loss or damage to those goods whilst in their custody, the shipper is the ultimate party who gets affected financially.

A prudent trader will ensure that all such risks will get transferred as a minimal cost and safeguard their financials. There are instances where due to existence of packing credit facility the Insurance becomes mandatory. It has been observed that a least attention is given whilst arranging for an insurance coverage of such Cargo movement. As the existence of Insurance coverage is considered necessary, the same need to be adequate to cover the types of losses arising during the transit.

Points ensuring the adequacy of Insurance Coverage

Information on the point to point movement of Cargo

- Terms of Sale (viz. CIF, CFR, FOB etc)

- Nature of the Cargo

- Basis of Valuation

- Country of Destination

An adequate coverage will always ensure that that the consignee’s interest is taken care off if the Consignment suffers any damages or remains undelivered.

Although Digitization has made it easy for the insurance seekers to obtain insurance at a click of mouse, the consignee may face a short fall in the claim amount or denial of claim due to insurance cover not being as per their requirements.

Spectrum Advisors (laxminarayan@spectrumadvisors.in)